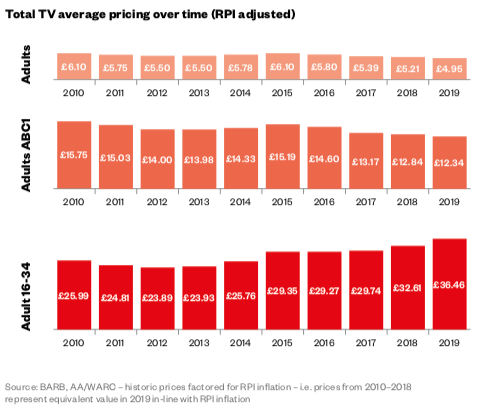

Some TV audiences are cheaper now

Linear TV advertising is priced on a supply and demand basis, so changes in either affect the price paid by advertisers. With RPI outpacing TV investment (£10 in 2019 is equivalent to £13 in 2010 according to ONS RPI data, while linear TV spot revenues in 2019 are pretty much on a par with 2010) and TV’s broad audience holding up, prices for audiences such as Adults and ABC1 Adults are, in fact, deflating. No one is complaining about that obviously (or really mentioning it at all).

Some TV audiences cost more

However, with young audiences migrating to VOD at a faster rate than 35+ audiences, we’ve seen increases in the price for linear TV audiences such as 16–34s over the last few years. For advertisers, the frustration of supply-driven increases in the price

of younger linear TV audiences

is understandable.

But the uncomfortable reality for advertisers looking to target younger audiences through AV advertising is that there isn’t a substitute for TV. TV advertising hasn’t been replaced. Most of the viewing that has been lost from TV has moved to non-commercial, less-viewed or less-effective advertising environments. As a result, TV continues to account for the vast majority of AV advertising time; 84% for 16–34s and rising to 93% for all individuals.

Source “Thinkbox”